A Beginner’s Guide to Altcoins: Unlocking the World Beyond Bitcoin

Welcome to Altcoins: What They Are and Why They Matter

If you’re just starting out in cryptocurrency, chances are you’ve heard of Bitcoin. But what about the thousands of other digital coins that aren’t Bitcoin? These are known as altcoins — a term that simply means “alternative coins.” In this beginner’s guide to altcoins, we’ll explore what they are, how they differ from Bitcoin, and how you can safely begin buying, trading, and investing in them.

Altcoins are more than just imitators. Many are built to solve specific problems or offer new features that Bitcoin doesn’t provide. Some focus on faster transactions, others on privacy or environmental impact. The altcoin ecosystem is diverse and ever-growing, making it a fascinating entry point for new crypto users in 2025.

How Altcoins Work (And How They’re Different from Bitcoin)

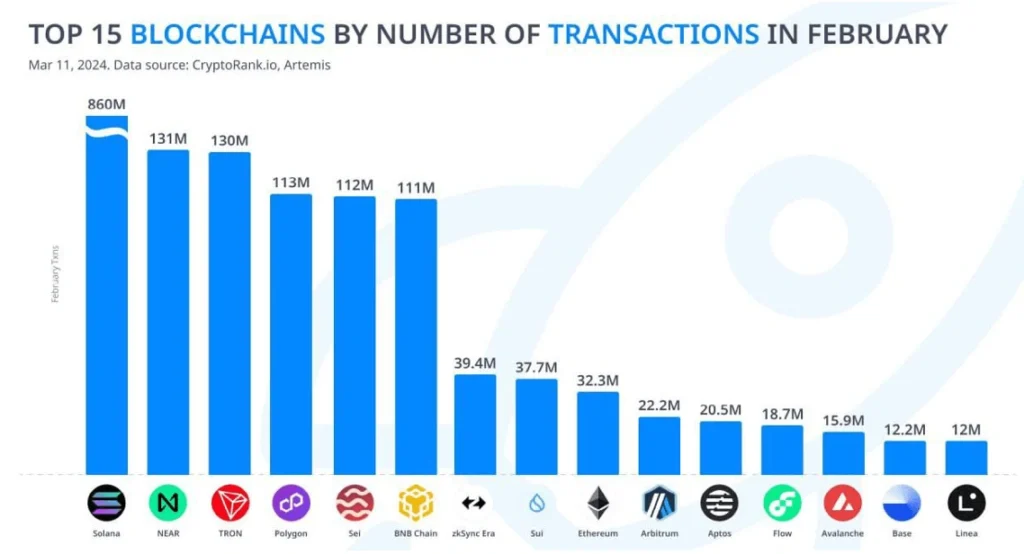

At the heart of every altcoin is blockchain technology — a decentralized system that records transactions securely and transparently. However, each altcoin uses this technology in different ways. For example, Ethereum introduced the concept of smart contracts, while coins like Solana emphasize speed and low fees.

What sets altcoins apart from Bitcoin is often their purpose. While Bitcoin is primarily viewed as digital gold or a store of value, altcoins like Cardano, Polkadot, or Avalanche aim to power decentralized applications, improve scalability, or offer governance features that Bitcoin doesn’t support.

Understanding this difference is essential. It’s not just about the price — it’s about function, vision, and community.

Getting Started: How to Buy Altcoins in 2025

Credit from Merehead

Buying altcoins today is easier than it was just a few years ago. The first step is choosing a reputable exchange. Platforms like Binance, Coinbase, Kraken, and KuCoin offer a wide range of altcoins, from top-ranked projects to emerging tokens.

Once you’ve registered and verified your identity, you can fund your account using fiat currency (like USD or MYR) or Bitcoin. From there, you’ll be able to search for altcoins by symbol (e.g., ETH for Ethereum, ADA for Cardano) and make your purchase.

Some newer altcoins may only be available on decentralized exchanges (DEXs) like Uniswap or PancakeSwap. These platforms let you trade directly from your wallet, offering access to tokens not yet listed on major exchanges. However, they come with higher risk and require more technical know-how.

Beginner’s Guide to Altcoins Wallets: Keeping Your Coins Safe

Once you own altcoins, the next question is: where do you keep them?

There are two main options — hot wallets and cold wallets. Hot wallets are connected to the internet and often built into exchanges or mobile apps. They’re convenient for frequent traders but more vulnerable to cyber threats.

Cold wallets, like hardware wallets (Ledger, Trezor) or paper wallets, are offline and offer a much higher level of security. If you’re planning to hold altcoins long-term, cold storage is usually the safest bet.

Don’t underestimate the importance of wallet safety. Beginners often leave coins on exchanges, but this comes with risks. A compromised exchange or phishing attack could result in the loss of your funds.

Investing in Altcoins: How to Make Smart Choices

Altcoin investing can be rewarding — but it’s also where many beginners get burned. With thousands of coins on the market, not all have long-term value. That’s why research is essential.

Here’s what to look for:

- Project utility: What does the altcoin aim to do?

- Team and development: Who is building it, and are they active?

- Community support: Are people genuinely using and promoting the coin?

- Market cap and liquidity: Is there enough volume to buy or sell without major slippage?

It’s also smart to avoid “hype coins” that surge overnight based on rumors or influencer promotions. Real value is usually built slowly.

Trading Altcoins: Basics Beginner’s Guide to Altcoins

Trading altcoins is different from simply buying and holding. It involves timing the market to buy low and sell high, often within shorter timeframes. Beginners should be cautious here — crypto prices can change rapidly, and emotional decisions often lead to losses.

To start, learn how to read charts and understand technical indicators like RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence). Most exchanges offer demo or “paper” trading modes to help users practice without real money.

You might also explore stablecoin pairs (e.g., trading ETH/USDT) for more stable pricing or use stop-loss orders to protect against sharp drops.

Altcoins vs Bitcoin: Understanding the Core Differences

Credit from Vocal Media

Bitcoin remains the first and largest cryptocurrency, with the most widespread adoption and strongest network security. But altcoins offer diversity and innovation.

Where Bitcoin is digital gold, many altcoins are platforms — like Ethereum’s smart contract layer or Chainlink’s oracle network. This difference is why some investors hold both: Bitcoin for stability, altcoins for potential growth.

Still, altcoins are generally more volatile. Their lower market caps mean prices move faster — both up and down. That’s why altcoin investing should complement, not replace, a more balanced crypto strategy.

Beginner’s Guide to Altcoins:Avoiding Scams and Choosing the Right Altcoin

Sadly, the crypto space isn’t free from fraud. From rug pulls to fake websites, scams are everywhere — and they often target newcomers. Always double-check contract addresses, avoid unsolicited offers, and never share your seed phrase.

Before investing in any altcoin, go through the basics:

- Read the whitepaper (official project document)

- Check listings on CoinMarketCap or CoinGecko

- Search the project’s name + “scam” to catch any red flags

- Join the community — Telegram, Discord, Twitter — and observe the conversation

If it sounds too good to be true, it usually is.

Beginner’s Guide to Altcoins Conclusion: Exploring Altcoins with Confidence

Altcoins open the door to innovation, experimentation, and — yes — risk. But for those willing to learn, they offer far more than just financial opportunity. They represent the evolving landscape of blockchain technology.

This beginner’s guide to altcoins is just the first step. Whether you’re curious about decentralized finance, eco-friendly coins, or the next big crypto project, the altcoin world is full of stories waiting to be told — and explored.

As long as you move thoughtfully, stay informed, and prioritize safety, you can explore this new frontier with clarity and confidence.